Table Of Contents

What Is The Special Purpose Vehicle?

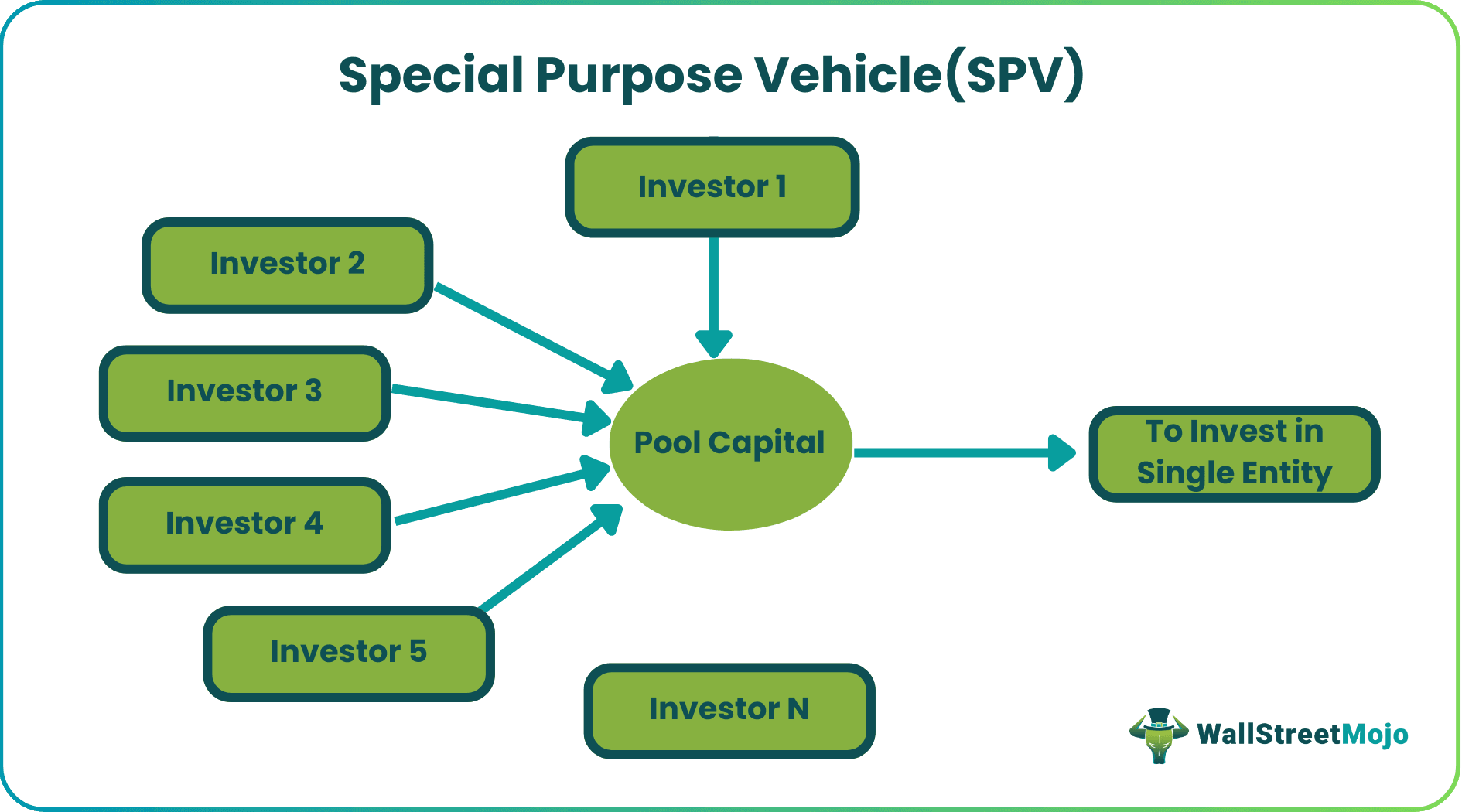

Special Purpose Vehicle (SPV) is a separate legal entity mostly created for a single, well-defined and specific lawful purpose. It acts as the bankruptcy remote for the main parent company.

In case of the company's bankruptcy, the SPV can carry out its obligations as the operations are restricted to the buying and financing of specific assets and projects. The terminology or importance of a special purpose vehicle came into much usage and popularity after the Enron debacle.

Special Purpose Vehicle Explained

A Special Purpose Vehicle, also known as Special Purpose Entity (SPE), is set up to mitigate financial risks to the utmost possible extent. Poor risk management and no clear understanding of the implied risks lead to the downfall of some high-profile companies and businesses. In such a scenario, SPV becomes an entity that helps companies assess risks and deal with them.

Several regulatory and transaction methods have been changed for special purpose vehicles after the collapse of Lehman Brothers in 2008. The documentation process should now be compliant with the Basel III norms, earlier Basel II. It is now particularly going through the below checkpoints :

- Stricter legal risk management by the company and regulators;

- Higher emphasis imposed on counterparty risk, specifically in case of the capital market structures practices by any company;

- The lending documentation process tightened.

- Higher use of ratios like debt-to-equity and other valuation ratios in restructuring a company's capital.

The risks can be further handled better with four essential practices – governance, oversight, motivation, and assessment. Thus, SPV’s creation by any company can be seen as the two sides of the same coin. Given the failures, policies have been made tighter to see that the pros of an SPV can be increased effectively.

Purpose

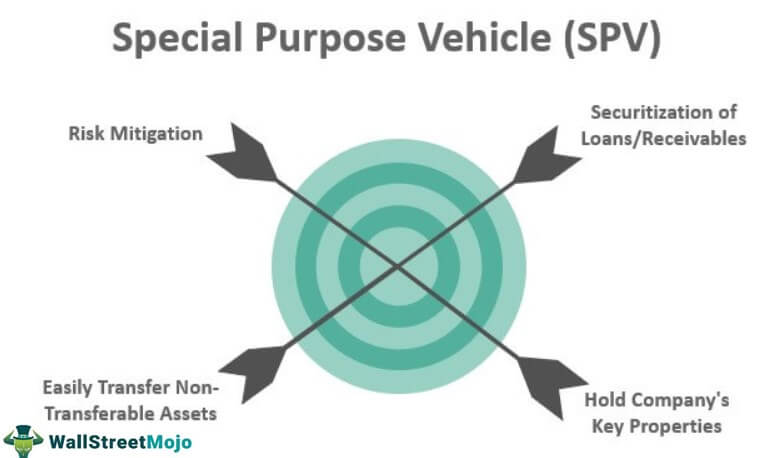

The SPV is established by a company with the specific objective of keeping it protected from financial risks in the event of bankruptcy. However, there are multiple other reasons why an entity must have a special purpose vehicle. Some of them have been listed below:

#1 - Risk Mitigation

Any company entails a significant amount of risk in its regular operations. The SPVs established helps the parent company to isolate the risks involved in projects or operations legally.

#2 - Securitization of Loans/Receivables

Securitization of loans and other receivables is one of the most common reasons to create an SPV. In the case of mortgage-backed securities, the bank can separate the loans from the other obligations it has by just creating an SPV. Therefore, this special purpose vehicle allows its investors to receive any monetary benefits before any other debtors or stakeholders of the company.

#3 - Easily Transfer Non Transferable Assets

reason, an SPV is created to own such assets. If the parent company wants to transfer the assets, they sell off the SPV as a self-contained package rather than splitting any asset or having various permits to do the same. Such cases occur in the case of mergers and acquisitions processes.

#4 - Hold Company's Key Properties

An SPV is sometimes created to make it hold a company's property. In cases when the property sales are much higher than the capital gains for the company, it will choose to sell the SPV rather than the properties. It will help the parent company pay the tax on its capital gains rather than on the proceeds of the sale of the property.

Examples

Let us consider the following examples to understand how SPVs work and isolate financial risks:

#1 - Enron

By 2000, ENRON was known to create hundreds of SPVs and would transfer the quickly-earned money in the form of profit by the rising stock to them and receive cash in return. However, it had created these SPVs mostly to hide these billions of dollars in debt, which resulted from failed projects and deals.

In 2001, When the reality came to light, and the debts were uncovered, the share price tumbled from $90 to less than $1 in just a few weeks; shareholders had to bear a loss of approximately $11 billion.

On Dec 2, 2011, Enron shut its SPVs and filed for Chapter 11 bankruptcy.

#2 - Bear Sterns

Bear Stearns had created multiple SPVs intending to raise securitized loans using the assets helped by the SPVs. However, it continued to take significant exposure and eventually collapsed when it could not revive the company even after closing all the SPVs. After this failed emergency rescue, Bear Stearns was finally sold to JP Morgan Chase in 2008.

#3 - Lehman Brothers

The story of Lehman Brothers and its failure is not hidden. The insolvency of the pillar in 2008 was proof of the weaknesses in maintaining the SPV's created and their documentation where the Lehman Brothers acted as the Swap Counterparty. Most of the SPVs were either not registered or did not have a proper documentation process. It resulted in piling unforeseen liabilities, which could never be resolved, and the Lehman Brothers had to announce bankruptcy in the year 2008

Benefits

When a company sets up an SPV, it is likely to enjoy many benefits out of it. A few of them are as follows:

- Private companies and establishments have easier access to capital markets by creating SPVs.

- Securitization of loans is the most common reason for creating SPVs; generally, the interest rates payable on the securitized bonds are lower than those offered on the corporate bonds of the parent company.

- Since the company's assets can be held with the SPV, they remain safe and secure. When the company faces financial problems, it ultimately reduces the credit risk for the investors and stakeholders.

- The credit rating of the SPV remains good; therefore, the investors find it reliable to buy the bonds.

- The shareholders and investors have undiluted ownership of the company.

- Tax savings can be done if the special purpose vehicle is created in any tax haven country like the Cayman Islands.

Limitations

Though the advantages of a special purpose vehicle are many, it doesn’t make it flawless. There are a few disadvantages of having an SPV too, which companies setting them up must know of. Here is a list of some of them:

- In the case of closing the SPV, the company would have to take back the assets, which would mean substantial costs being involved.

- The creation of a special-purpose vehicle might mean restricting the money-raising capacity of the parent company.

- Direct control over some assets of the parent might be diluted, which may, in turn, may reduce the ownership at the time of dilution of the company.

- In case of any changes in the regulations, there are high chances of severe complications for the companies that created these special vehicles.

- If the SPV sells an asset, the parent company's balance sheet will get negatively affected.

- The special purpose vehicle might have lesser access to capital and raise capital from the public because it does not have the same credibility in the market as the sponsor or parent company.

Special Purpose Vehicle (SPV) Vs Joint Venture (JV)

SPV and JV are the two terms that play a major role in the corporate sector when it comes to risk management. However, these two differ widely in multiple aspects. Let us a have look at the differences between them:

- JV is a setup where two or more parties come together for a business and share rewards and risks equally. On the other hand, SPV is an arrangement of a parent company to look after the financial risks associated in the event of financial crisis or bankruptcy.

- While JV is a long-term arrangement that blossoms as a partnership between the parties involved, SPV is a short-term setup established to serve a specific purpose.